China’s Ministry of Commerce has warned that a growing conflict between the Dutch headquarters of semiconductor manufacturer Nexperia and its Chinese division could trigger another global chip shortage. Beijing claims that recent actions by the company are escalating the dispute and could once again disrupt international semiconductor supply chains.

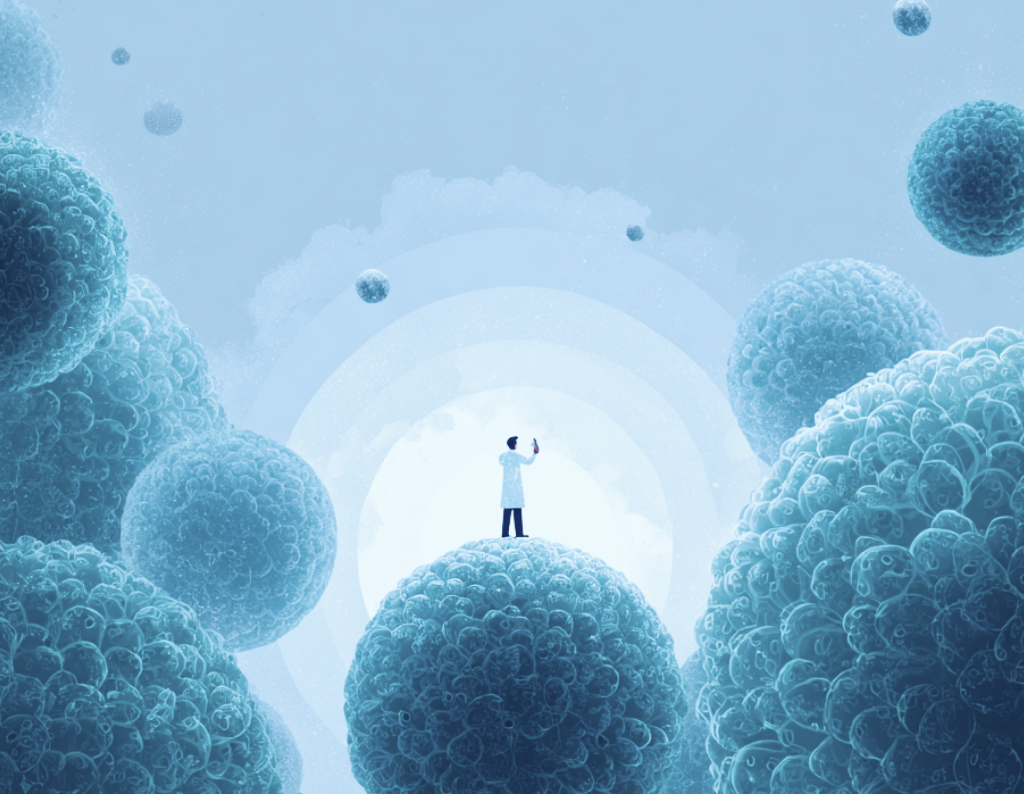

A new Nature Communications study suggests that insulin resistance tracks with higher risk for 12 cancer types. An international research team applied an unusual approach — instead of measuring insulin resistance directly, they developed an algorithmic proxy, opening the door to population-scale risk analyses. Here’s why that matters.

Language models are widely capable of answering health-related questions — a topic that the media have covered extensively. These are truly remarkable advancements. However, the process of implementing them into real life rarely draws the same attention; it is accompanied by tedious paperwork and annoying safety issues.

AI models for healthcare are proliferating, but most never leave the labs. Real-world deployment is far more complicated than any multiple-choice graduate exam – hospitals use different systems, data formats, and security protocols that resist standardization. Kaapana, an open-source platform developed at the German Cancer Research Center, addresses translation barriers by providing standardized infrastructure for medical AI research.