Can you imagine a situation in which the prices of smartphones, cars, computers, or even washing machines and refrigerators start rising at an alarming pace because big tech companies are training AI systems using massive amounts of memory? It may sound like science fiction, but this is already becoming reality.

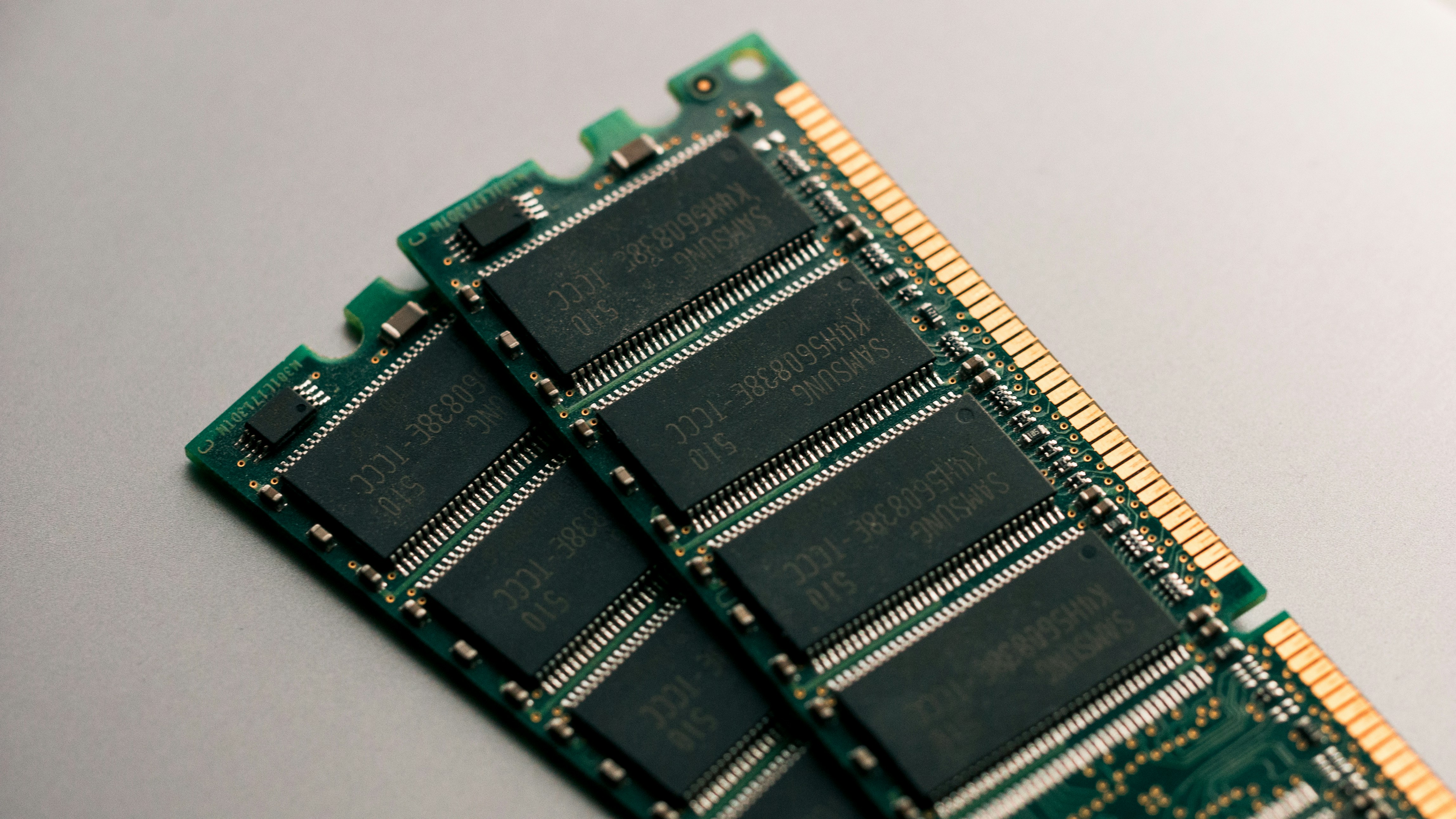

A report by The Wall Street Journal highlights that the surge in demand from AI giants has led to a situation where most available memory output is being diverted to data centers, deepening a global shortage of memory chips. This structural shift in supply is driven by the fact that modern AI systems and servers require far more memory than typical consumer devices. As a result, memory manufacturers such as Samsung, SK Hynix, and Micron are increasingly allocating production capacity to high-margin, high-bandwidth modules (such as HBM and advanced DDR5) for data-center use. This, in turn, limits the availability of memory for traditional products like laptops, smartphones, and other consumer electronics.

The consequences of this trend are already starting to be felt in other segments. Analysts suggest that memory shortages could translate into higher manufacturing costs for end devices. According to forecasts by IDC, constrained supply may push average laptop prices up by several percent and reduce the availability of configurations with larger amounts of RAM.

It is also worth noting that the pressure on memory supply is not caused by AI demand alone. Earlier decisions by chipmakers to cut production capacity in 2022–2023 reduced output just as demand began to rebound. Combined with the rapid expansion of AI infrastructure, this has resulted in what analysts describe as one of the most severe semiconductor memory crunches in history — one that could persist until 2027 or even 2028 (!), before new fabs and production lines significantly increase global supply.