American shoppers once again staged a record shopping marathon: according to Adobe Analytics, they spent $11.8 billion online on Black Friday 2025, 9.1% more than a year earlier. Globally, analysts put total online Black Friday sales at around $78–80 billion — and a substantial share of that pie now comes from European consumers hunting for discounts and increasingly turning to AI to help them choose what to buy.

According to Adobe, traffic to retailer websites coming via AI tools – such as Walmart’s Sparky or Amazon’s Rufus, which help shoppers search for discounts and compare prices – grew by roughly 805% year on year. Salesforce analysts point to an interesting trend: by their estimates, AI agents influenced/ $14.2 billion in online sales worldwide, about $3 billion of that in the US.

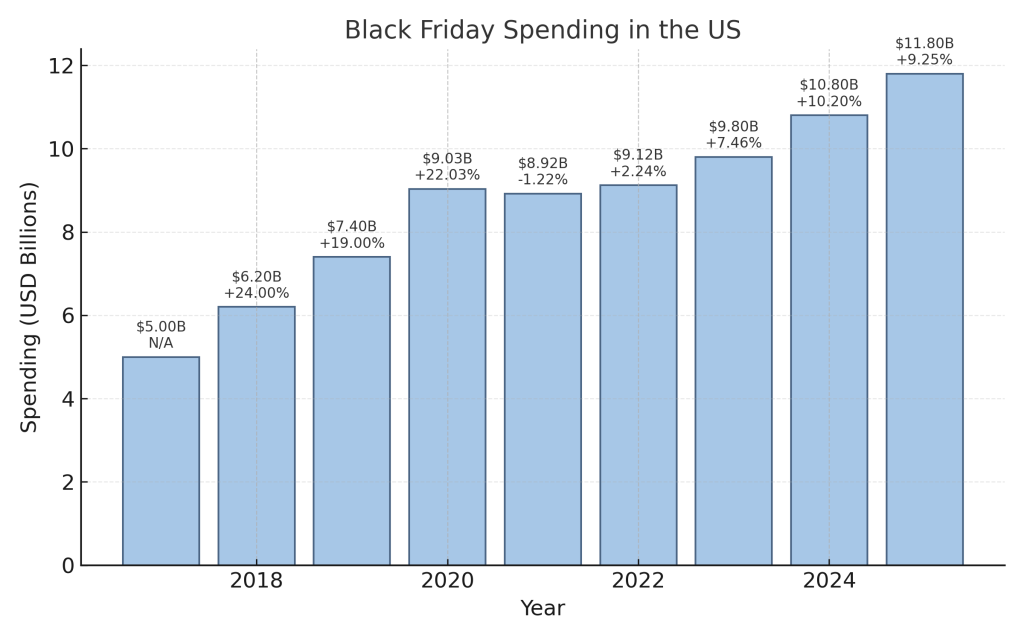

Black Friday sales have been rising steadily for many years, with only a brief dip in the pandemic year of 2021.

What about offline retail? According to estimates from Mastercard SpendingPulse and eMarketer, traditional brick-and-mortar sales in the US grew by only about 1.7%.

One important nuance: revenue is growing not only because of the number of purchases, but also because of higher prices. The average price per item rose by roughly 7%, while order volume (number of orders) fell by about 1%, and the number of items in each order decreased by around 2%.

Finally, in the US, Black Friday is also a warm-up for Cyber Monday. Adobe forecasts around $14.2 billion in online sales on Cyber Monday (an increase of about 6.3% year on year), with the steepest discounts expected on electronics, clothing and computers.